Crypto valuation – you either like them or not! In a world where digital assets are playing an increasing role in treasury and operational finance, the need for clear, standardised, and accountable valuation processes are valuable. As organisations expand their exposure to crypto assets — whether as long-term holdings, operational liquidity, or as part of DeFi ecosystems — its important to have consistency of valuatoin.

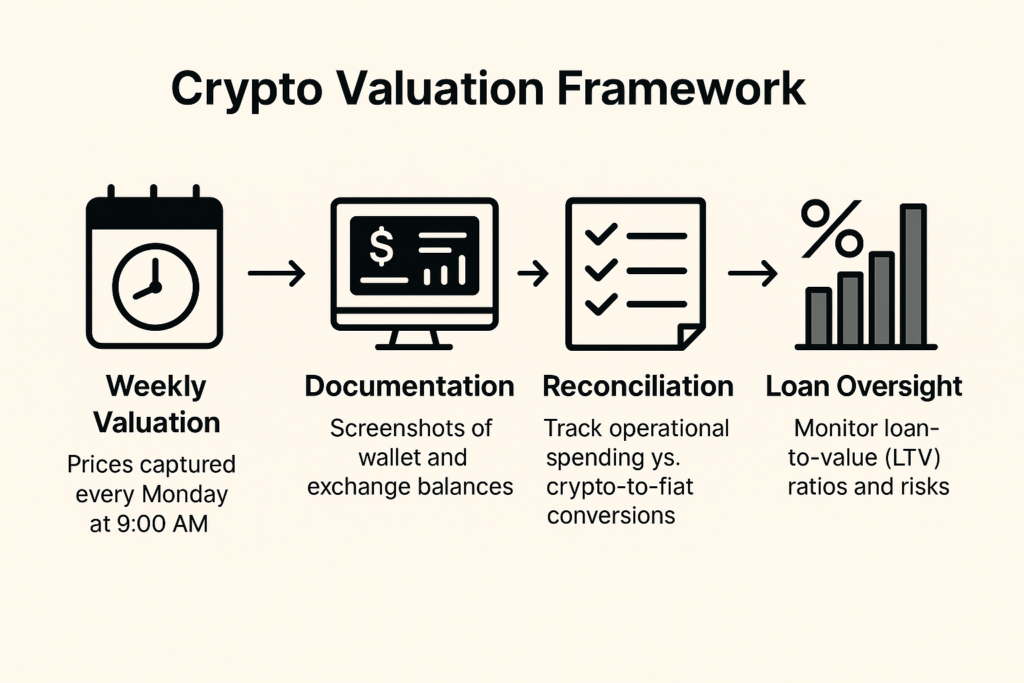

Here’s a framework designed to meet those needs with clarity, consistency, and control.

Who is this article for?

This article is for CFOs, controllers, and managers responsible for reporting on values held for crypto assets. It outlines a structured, practical approach to weekly crypto valuation, asset monitoring, and loan account management if you have them.

Why Crypto Valuation Matters for Treasury and Opex Functions

While much of conversation has revolved around how volatile crypto can be, a growing number of firms hold digital assets as part of their treasury as an alternate form of asset. They are also used widely for payments and working capital.

For these companies, crypto isn’t just an investment – it’s capital. Managing it requires the same level of diligence, auditability, and reporting integrity as fiat Whether it’s stablecoins being swapped for fiat or tokens being collateralised for loans, weekly visibility into asset values and positions is vital.

A Weekly Valuation Framework for Crypto Assets

1. Timing is Everything: The 9 AM Rule

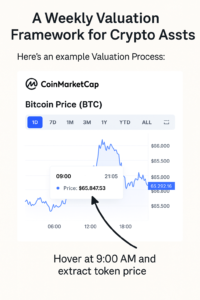

To ensure consistency in calculations used week to week, crypto valation should be standardised using token prices captured at a certain time each week like, 9:00 AM every Monday. This timestamped pricing approach anchors weekly valuations and creates comparability week-over-week.

Also have a single data source for these prices, in our case we use CoinMarketCap, which was chosen for its wide market coverage.

- Navigate to CoinMarketCap

- Search for each token (e.g., BTC, ETH, FET)

- Select the “1 Day” graph for a 24-hour price snapshot

- Hover over the graph to pinpoint the 9:00 AM value

- Record the 9 AM price on your valuation matrix or table and value your tokens.

This routine ensures a single source of truth for asset pricing — removing variability and allowing finance teams to anchor decisions and reconciliations to a precise, repeatable market snapshot.

2. Documentation Through Screenshots: Building the Audit Trail

How do you prove the existence of the specific crypto at a point in time. Even software that allows for crypto valuation doesn’t provide a point in time value. This is important for audit trail and we employ the same approach used for trading capital industries for stock verification. Each valuation is substantiated through screenshots wallet and exchange balances at the point of recording these balances, appreciate this is a lot to do so we focus on large balances. These serve as critical backups which can be provided in the event of an audit.

Process to follow:

- Access public blockchains or for internal personnel wallets within the organisation and aim to take screenshots of various balances held.

- Capture screenshots of token balances and fiat equivalents

- Store them in the working files of that month (organised by week) as a folder on your Dbox or G-drive

- For month-end valuations, conduct the same process as of the last calendar day of the month, saving these screenshots in a separate folder where possible

These screenshot values should feed directly into monthly management accounts and external reporting.

Weekly Reconciliations for Operational Tokens

Certain tokens, in your repertoire, are earmarked for operational use and are regularly converted into fiat or stablecoins to fund operating expenses. Maintaining visibility for these balances is critical, especially when actively managing treasury drawdowns and burn rates.

Each week, a reconciliation should be performed to see bydget vs actual spend for these specific tokens.

- Track real-time spending capacity

- Avoid overspending or sudden shortfalls

- Maintain price parity if conversions are done

By comparing previous week’s closing balances with current holdings, discrepancies or unexpected changes (e.g., incoming transfers, unauthorised spending, exchange errors) can be quickly identified and resolved. Leave to the end of the month or quarter, it becomes more hazzle.

Managing Crypto Loans and Monitoring LTV

You may have collatirised assets via platforms like LEDN — centralised crypto lending platform or Aave — a decentralised lending protocol accessed via MetaMask

These loans are often collateralised with Bitcoin, Eth, or other high-cap tokens, making Loan-to-Value (LTV) monitoring a central treasury task.

Weekly Loan Oversight Checklist:

- Log in to relevant platforms

- Go to the loan or collateral dashboard

- Review the current LTV and risk factor

- Record these or save screenshots based on what we mentioned above

Internal Risk Directives:

The biggest risk with crypto collaterals are the possibility of auto liquidations so it’s very important for an organisation to have their own internal risk appetite and related parameters. Here are the steps

- Always have a target LTV: Must remain below 65%

- Auto-liquidation threshold: Kicks in at 83% LTV for most loan platforms such as Aave

- Contingency Monitoring: During volatility, LTV and liquidation risks must be reviewed more frequently, potentially daily

Governance, Continuity, and Security

It’s not just about knowing what tokens are held and their value — it’s about operationalising that knowledge with security and governance in mind.

Best Practices:

- Use Lastpass or an equivalent enterprise password manager for all critical access credentials

- Segregate personal vs. organisational wallets

- Restrict access to seed phrases only to pre-authorised internal personnel.

- Back up all crypto valuation sheets and screenshots in encrypted cloud drives with version control

- Maintain a runbook or documentation of all procedures in case of personnel change or emergency access needs

Future Outlook: Automating Valuation Workflows

While this framework outlines a predominantly manual process, it lays the foundation for eventual automation. As the organisation scales, consider integrating:

- CoinMarketCap API or CoinGecko API for real-time pricing feeds

- Exchange account integration via platforms like Zerion, Zapper, or Nansen

- Custom dashboards to automatically calculate weekly positions and LTV ratios

- Automation of screenshots via browser scripting or crypto-specific accounting tools like CoinTracker, Koinly, or Cryptio

These upgrades reduce human error, reduce delays, and let finance teams focus more on analysis than data collection.

Conclusion and Next Steps

In the fast-paced world of crypto finance, structure is your safety net. Weekly crypto valuations, when done right, becomes more than a reporting obligation — it becomes the foundation for strategic capital allocation, risk management, and operational forecasting.

By anchoring valuation to a consistent time, backing numbers with proof, and tying it all to treasury and opex decisions, finance teams can bring reliability to how these values are presented in financial reports. Whether dealing with tokens held for the long term, actively traded for spending, or pledged as collateral, the principles remain the same: visibility, accountability, and consistency.

Looking to build a crypto valuation workflow tailored to your treasury? Reach out to our team or subscribe for more insights on managing digital assets with confidence and control.